Debt - A Macro Perspective

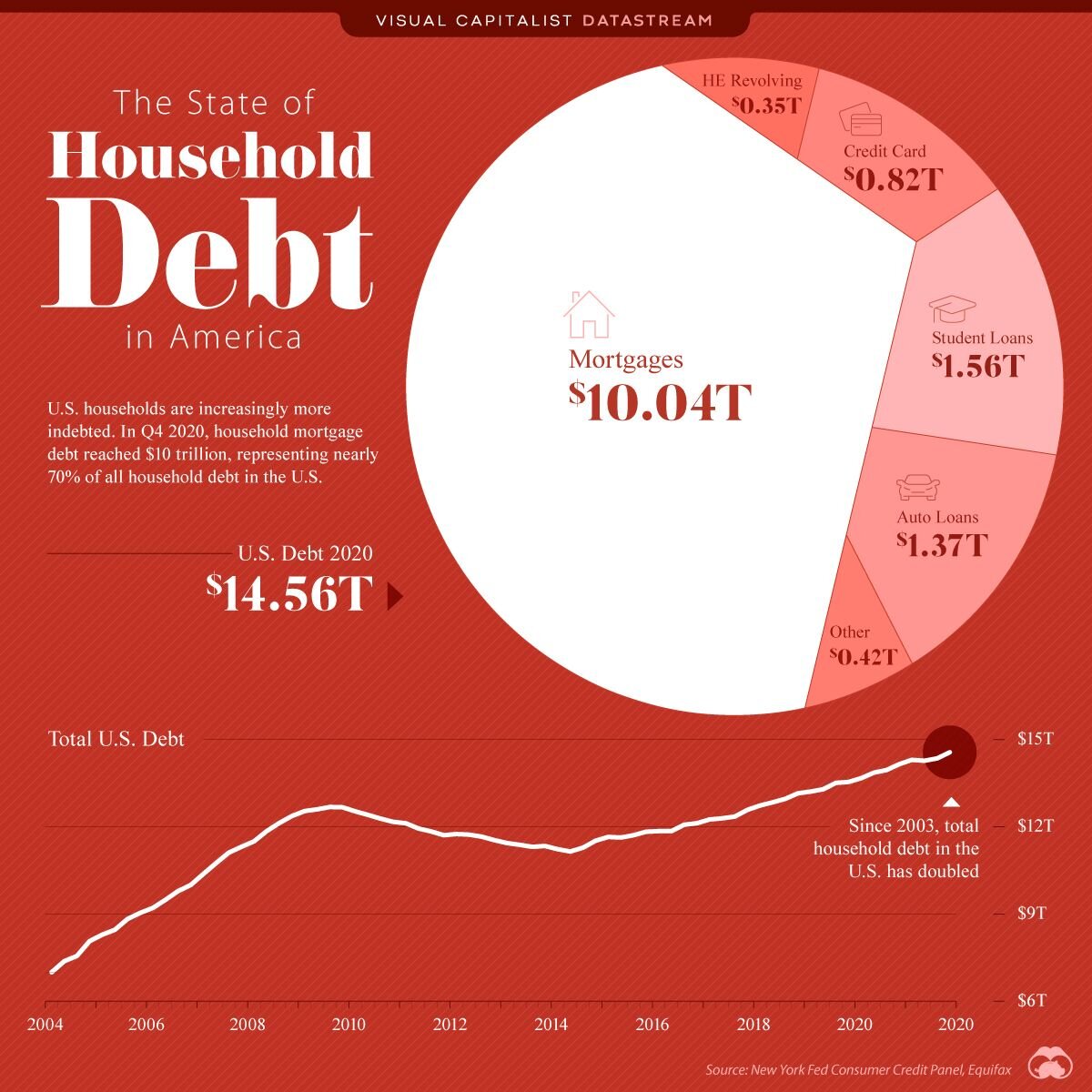

In 2021, total household debt in the United States reached $14.68 trillion, 3% of which is in some stage of delinquency. The Consumer Financial Protections Bureau (CFPB) reports that greater than one in four Americans, 28% of all American consumers, have at least one account in third-party collections. According to Experian, as of 2020 per capita debt reached record levels in each of the major loan categories: credit card ($5,315); mortgage ($208,185); auto ($19,703); personal loan ($16,458); HELOC ($41,954); and student loan ($38,792). The overall debt load of the average Maryland consumer stands at $123,320, exceeding a nationwide average of $92,727.

American businesses also now face the highest levels of debt on record, according to the Federal Reserve and the Securities Industry and Financial Market Association (SIMFA). A monetary policy of low interest rates (fiscal stimulus) adopted in the wake of the 2008 financial crisis led to a decade of cheap borrowing and increased debt liabilities for America’s corporations, who collectively owe over $10.5 trillion.

Over the same decade, the collection rate of third-party collection agencies fell from 30% to 20%. Each year, collection agencies contact U.S. consumers more than one billion times and generate over 850,000 consumer complaints with the Federal Trade Commission, far more than any other industry. Collection agencies lack the teeth (i.e., legal means) to compel recovery. As a result, debtors simply ignore collection agency letters and phone calls, leaving collection agencies with no other option but to hire lawyers to get the job done.

Courtesy of Visual Capitalist.